Bom artigo de Daniel Klein na Reason:

"Word for word, Hayek and Rothbard cannot be reconciled. Hayek had different sensibilities about policy reform, sensibilities that are larger, better considered, and more diplomatic. Hayek’s fairness to diverse social and political values, especially ones recognizing the importance of customs and traditions, sometimes led him to conclusions at odds with a Rothbardian line. Hayek knew that in propounding classical liberalism in the twentieth century the dialectics of discourse and expulsion from discourse could, over the years, paint him into a corner of crankiness and brittleness. Hayek was a bargainer. He paid keen attention to the several limitations of the liberty maxim."

Este outro é igualmente interessante, cujo tema é porque as pessoas amam governos. O ponto central é que libertarianismo radical (a la Rothbard e Ayn Rand) pode entrar em conflito com as necessidades da sociedade moderna, que se vê frente a novos problemas que podem demandar ação coletiva (terrorismo, problemas ambientais, propriedade intelectual, etc.) Desta forma, mais pragmática é a postura de Hayek, Cowen (que é considerado um "libertário de barganha" - aceitar o crescimento do governo apenas como parte do pacote de proteção às liberdades individuais) e do Gregory Mankiw, que se considera um libertário marginal - a maior parte dos problemas hoje pode ser resolvida com redução da intervenção de governo, e não com seu aumento.

quarta-feira, 28 de março de 2012

terça-feira, 27 de março de 2012

Fukuyama Sobre Acemoglu e Robinson

Ótima resenha de Francis Fukuyama sobre "Why Nations Fail". Ainda estou lendo o livro, mas sim: a tese central parece ser a mesma de North, Wallis e Weingast, mas com outra terminologia. As histórias contadas são bastante enriquecedoras, corroborando a teoria.

Frase do Dia

"Subsídios e incentivos fiscais são como crack e heroína: para continuar dando o mesmo efeito é necessário aumentar a dose, e se cortar o fornecimento dá síndrome de abstinência".

Yours Truly

Yours Truly

Marcadores:

Política industrial,

rent-seeking

segunda-feira, 26 de março de 2012

Milton Friedman: Conselhos ao Governo da Índia, 1955

O Memorando inteiro deveria ser entregue ao Ministro Mantega, mas a parte sobre política industrial salta à vista:

"Just as it is inappropriate to discriminate in favour of the cottage industries, so it is equally inappropriate to discriminate in favour of factory industry or large concerns. Granting them special favour the form of especially advantageous loans guaranteed markets, refusal of licenses to competitors, enforcing or even permitting private price-fixing and market-sharing agreements-simply encourages inefficiency and wastes scarce resources. If private industry is granted special favours by the Government, it is certainly inevitable that its use of these favours will be controlled; but this does not offset the harm done by the favours; it merely introduces new sources of rigidity and inefficiency. Business ingenuity is devoted to carving out protected sectors instead of to opening up new markets and lowering costs. There is no justification for private industry unless it is competitive, unless the right to receive profits is accompanied by acceptance of the risk of loss. Private industry should be made to stand on its own feet without either favour or harassment."

(HT: Tyler Cowen)

"Just as it is inappropriate to discriminate in favour of the cottage industries, so it is equally inappropriate to discriminate in favour of factory industry or large concerns. Granting them special favour the form of especially advantageous loans guaranteed markets, refusal of licenses to competitors, enforcing or even permitting private price-fixing and market-sharing agreements-simply encourages inefficiency and wastes scarce resources. If private industry is granted special favours by the Government, it is certainly inevitable that its use of these favours will be controlled; but this does not offset the harm done by the favours; it merely introduces new sources of rigidity and inefficiency. Business ingenuity is devoted to carving out protected sectors instead of to opening up new markets and lowering costs. There is no justification for private industry unless it is competitive, unless the right to receive profits is accompanied by acceptance of the risk of loss. Private industry should be made to stand on its own feet without either favour or harassment."

(HT: Tyler Cowen)

Marcadores:

Milton Friedman,

políticas de desenvolvimento,

rent-seeking

domingo, 25 de março de 2012

Qual é o Verdadeiro Custo da Corrupção e Rent-Seeking?

É a distância da Fronteira de Possibilidades de Produção (FPP) do país em questão da FPP internacional. No caso do Brasil, uns meros 300 a 400% do PIB.

ABSTRACT: What, if anything, can a country today do to catch-up with the industrial leaders? This paper reviews a theory of the evolution of international income levels and examines its predictions for catch-up. The main policy implication of this theory is that a country will catch-up to the industrial leaders if it eliminates policies that constrain the choice of technologies and work practices of its citizenry. Most often these policies exist to protect specialized factor suppliers and corporate interests. We examine the record of catch-up over the twentieth century and conclude that joining a free trade club is an effective way by which a country can eliminate these constraints.

ABSTRACT: What, if anything, can a country today do to catch-up with the industrial leaders? This paper reviews a theory of the evolution of international income levels and examines its predictions for catch-up. The main policy implication of this theory is that a country will catch-up to the industrial leaders if it eliminates policies that constrain the choice of technologies and work practices of its citizenry. Most often these policies exist to protect specialized factor suppliers and corporate interests. We examine the record of catch-up over the twentieth century and conclude that joining a free trade club is an effective way by which a country can eliminate these constraints.

Marcadores:

corrupção,

desenvolvimento econômico,

rent-seeking

Por Que Nações Fracassam? É a Política, Estúpido!

Política é o principal impedimento ao crescimento e desenvolvimento dos países, de acordo com o economista Daron Acemoglu e o cientista político Jim Robinson, em seu novo livro "Why Nations Fail":

"From Adam Smith and Max Weber to the current day, scores of writers have grappled with these questions. Some scholars, like Weber, have argued that religious or cultural differences create vastly different economic outcomes among countries. Others have asserted that a lack of natural resources or technical expertise has prevented poor countries from creating self-sustaining economic growth.

Economists Daron Acemoglu of MIT and James Robinson of Harvard University have another answer: Politics makes the difference. Countries that have what they call “inclusive” political governments — those extending political and property rights as broadly as possible, while enforcing laws and providing some public infrastructure — experience the greatest growth over the long run. By contrast, Acemoglu and Robinson assert, countries with “extractive” political systems — in which power is wielded by a small elite — either fail to grow broadly or wither away after short bursts of economic expansion."

"Elites, Why Nations Fail asserts, resist innovation because they have a vested interest in resisting change — and new technologies that create growth can alter the balance of economic or political assets in a country.

“Technological innovation makes human societies prosperous, but also involves the replacement of the old with the new, and the destruction of the economic privileges and political power of certain people,” Acemoglu and Robinson write. Yet when elites temporarily preserve power by preventing innovation, they ultimately impoverish their own states."

"From Adam Smith and Max Weber to the current day, scores of writers have grappled with these questions. Some scholars, like Weber, have argued that religious or cultural differences create vastly different economic outcomes among countries. Others have asserted that a lack of natural resources or technical expertise has prevented poor countries from creating self-sustaining economic growth.

Economists Daron Acemoglu of MIT and James Robinson of Harvard University have another answer: Politics makes the difference. Countries that have what they call “inclusive” political governments — those extending political and property rights as broadly as possible, while enforcing laws and providing some public infrastructure — experience the greatest growth over the long run. By contrast, Acemoglu and Robinson assert, countries with “extractive” political systems — in which power is wielded by a small elite — either fail to grow broadly or wither away after short bursts of economic expansion."

"Elites, Why Nations Fail asserts, resist innovation because they have a vested interest in resisting change — and new technologies that create growth can alter the balance of economic or political assets in a country.

“Technological innovation makes human societies prosperous, but also involves the replacement of the old with the new, and the destruction of the economic privileges and political power of certain people,” Acemoglu and Robinson write. Yet when elites temporarily preserve power by preventing innovation, they ultimately impoverish their own states."

Corridas Bancárias do Séc. XXI

Corridas bancárias do séc. XXI são diferentes, como explica Tyler Cowen:

"The new complication is that bank deposits are no longer the dominant form of modern short-term finance. The modern bank run means a rush to withdraw from money market funds, the disappearance of reliable collateral for overnight loans between banks or the sudden pulling of short-term credit to a troubled financial institution. But these new versions are in some ways still similar to the old: both reflect the desire to pull money out of an endeavor — and to be the first out the door. And both can set off a crash.

These newer forms occur in the so-called shadow banking system, involving short-term financial credit not guaranteed by the deposit insurance umbrella. According to the Federal Reserve Bank of New York, shadow banking accounts for about $15 trillion in assets — more than the traditional banking system. But as recently as 1990, the shadow-banking total was much lower, at less than $4 trillion. The core problem is that the growth of short-term credit has been outracing our ability to protect it, and since 2008 most investors have realized that these shadow-banking transactions are not risk-free"

segunda-feira, 19 de março de 2012

Teoria dos Jogos: Stanford Oferece Curso Gratuito

Ótima novidade para quem deseja aprender teoria dos jogos: um curso on-line gratuito. Começa dia 19/03 (hoje!) mas as matrículas podem ser feitas até 25/03. Vale a pena descobrir o fascinante universo de teoria dos jogos! Maiores informações aqui.

quinta-feira, 15 de março de 2012

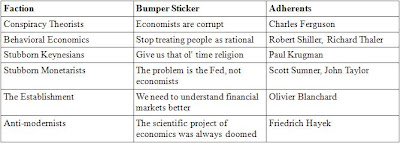

O Estado Atual da Macroeconomia

Arnold Kling tem dois artigos muito informativos, este e este. Um terceiro ainda está por vir, com suas interpretações. Bradford DeLong, embora mais restrito sobre política monetária, também vale a pena ler.

Origem e Formação do Estado

O abstract abaixo explica tudo:

"This research attempts to explain the large differences in the early diffusion of the mafia across different areas of Sicily. We advance the hypothesis that, after the demise of Sicilian feudalism, the lack of publicly provided property-right protection from widespread banditry favored the development of a florid market for private protection and the emergence of a cartel of protection providers: the mafia. This would especially be the case in those areas (prevalently concentrated in the Western part of the island) characterized by the production and commercialization of sulphur and citrus fruits, Sicily’s most valuable export goods whose international demand was soaring at the time."

Qualquer semelhança com o Brasil não é mera coincidência...

"This research attempts to explain the large differences in the early diffusion of the mafia across different areas of Sicily. We advance the hypothesis that, after the demise of Sicilian feudalism, the lack of publicly provided property-right protection from widespread banditry favored the development of a florid market for private protection and the emergence of a cartel of protection providers: the mafia. This would especially be the case in those areas (prevalently concentrated in the Western part of the island) characterized by the production and commercialization of sulphur and citrus fruits, Sicily’s most valuable export goods whose international demand was soaring at the time."

Qualquer semelhança com o Brasil não é mera coincidência...

Marcadores:

crescimento do governo,

direitos de propriedade,

falhas de governo,

máfia

Estimando Melhor os Multiplicadores Fiscais

Para abalar crenças a respeito da magnitude dos multiplicadores fiscais:

"In this note, we demonstrate and analyze the inability of standard neoclassical models to generate accurate estimates of the fiscal multiplier (that is, the macroeconomic response to increased government spending). We then examine whether estimates can be improved by incorporating recently developed theory on demand-induced productivity increases into neoclassical models. We find that neoclassical models modified in this fashion produce considerably better estimates, but they remain unable to generate anything close to an accurate value of the fiscal multiplier."

HT: Shikida

"In this note, we demonstrate and analyze the inability of standard neoclassical models to generate accurate estimates of the fiscal multiplier (that is, the macroeconomic response to increased government spending). We then examine whether estimates can be improved by incorporating recently developed theory on demand-induced productivity increases into neoclassical models. We find that neoclassical models modified in this fashion produce considerably better estimates, but they remain unable to generate anything close to an accurate value of the fiscal multiplier."

HT: Shikida

Marcadores:

estímulo fiscal,

multiplicadores fiscais

Coisa de Doido

Governo brasileiro faz proposta para a China capturar ganhos de monopólio em detrimento do superávit do consumidor (até aí, ok, é uma tradição das políticas econômicas do país) e de receitas próprias! Alex explica toda a maluquice. Me parece que o CADE, para conseguir enquadrar o governo brasileiro, precisa contratar psiquiatras.

quarta-feira, 7 de março de 2012

Tsunami Monetário e Protecionismo Unilateral: Lendo as Entre-linhas

Ao criticar a crescente liquidez estimulada recentemente pelos Bancos Centrais da Europa (BCE) e dos Estados Unidos (FED), a Presidente Dilma Rouseff anunciou poderia tomar medidas para proteger o Real de apreciações "artificiais". Parece que uma simples questão de lógica econômica escapou da compreensão dos assessores econômicos da Presidente: Medidas protecionistas, de restrições às importações, tendem a valorizar ainda mais o Real por reduzirem a demanda por dólares. Talvez o problema não seja a dificuldade de compreensão de como funciona o mercado de câmbio, mas um de origem política que se encontra nas entre-linhas do discurso nacional-desenvolvimentista do governo brasileiro: A Presidente na verdade está dizendo que é preciso proteger os grupos econômicos, como os exportadores industriais, que financiam as campanhas políticas dos partidos que constituem a chamada base aliada. Pois se o problema fosse apenas de câmbio valorizado, a liberalização unilateral das importações resolveria o problema, além de tornar mais barato o consumo para os milhões de brasileiros que se encontram desprotegidos contra a ineficiência e baixa produtividade da indústria nacional.

|

| Vou lhe proteger, mas sei que quando precisar, nas próximas eleições, você estará do meu lado. |

Marcadores:

protecionismo,

taxa de câmbio real

Vem aí o II Encontro Nacional dos Blogueiros em Economia

Será melhor do que o primeiro, que tive o prazer de participar, que também foi uma iniciativa do Cristiano Costa e do Cláudio Shikida. Infelizmente, apesar de constar na lista de painelistas, ficou impossível minha ida à Minas Gerais. Os temas e os demais painelistas são muito bons e vale a pena participar. Inscrições e maiores informações aqui.

Assinar:

Comentários (Atom)